Top 10 Home Insurance Companies in UK

Table of Contents

Top 10 Home Insurance Companies in UK

Are you on the hunt for the best home insurance policy in the UK? Look no further! We have compiled a list of the top 10 home insurance companies in the country to make your search easier. With so many options available, it’s important to choose a reliable and trustworthy provider. From i4me limited to Safeguard UK Insurance, we’ve got all your needs covered. So sit back, relax, and let us guide you through our selection of the best home insurance companies in the UK – your dream policy is just a few clicks away!

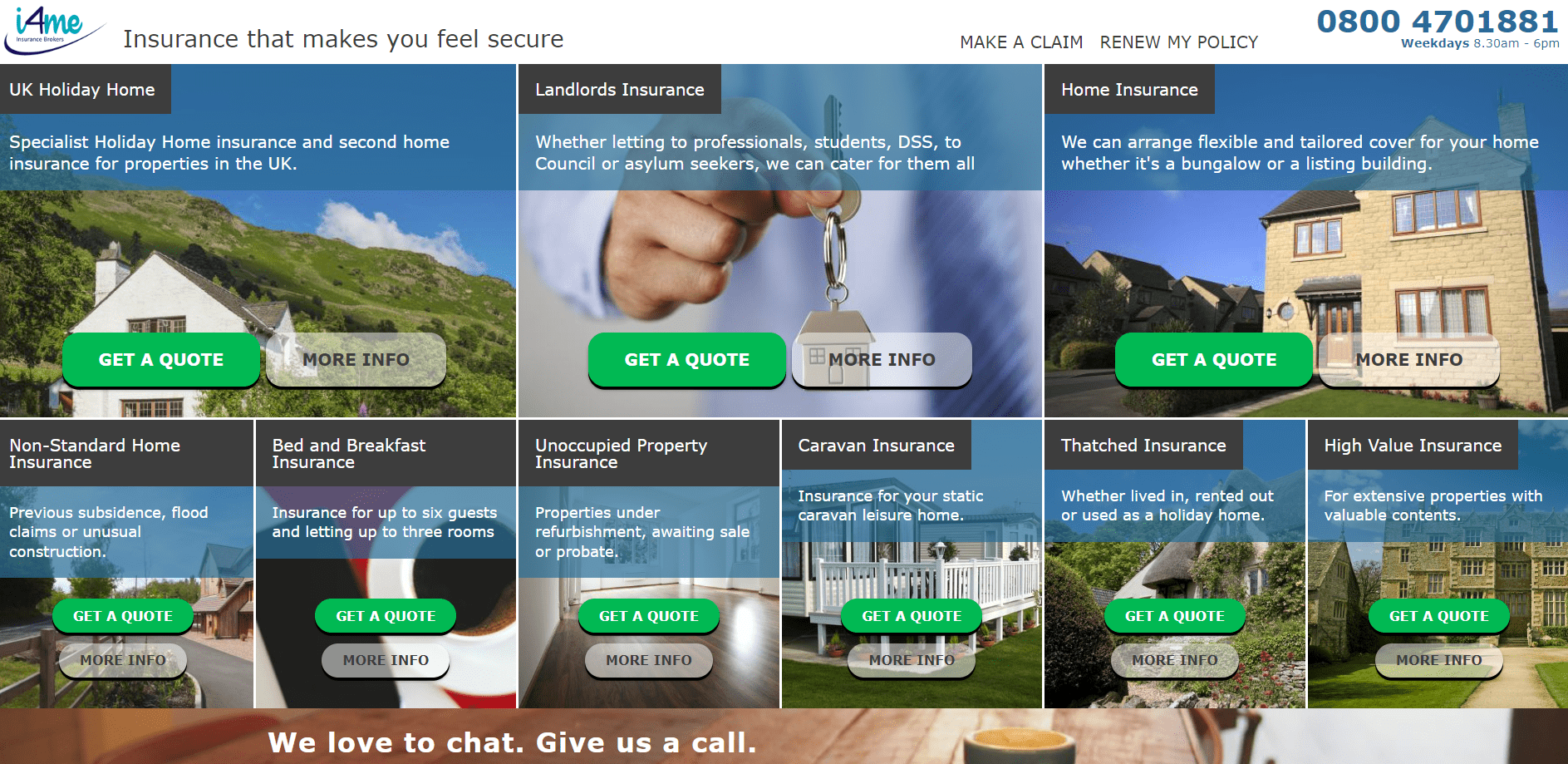

1. i4me limited

i4me limited is a home insurance provider that offers peace of mind to homeowners across the UK. With over 30 years of experience in the industry, i4me has earned a reputation for providing comprehensive coverage at competitive prices. One unique aspect of i4me’s policies is their focus on personalization – they offer tailored packages to suit your specific needs and preferences. Whether you’re looking for cover for your home, contents or both, i4me can provide a policy that fits like a glove.

i4me limited is a home insurance provider that offers peace of mind to homeowners across the UK. With over 30 years of experience in the industry, i4me has earned a reputation for providing comprehensive coverage at competitive prices. One unique aspect of i4me’s policies is their focus on personalization – they offer tailored packages to suit your specific needs and preferences. Whether you’re looking for cover for your home, contents or both, i4me can provide a policy that fits like a glove.

Their customer service team is available around-the-clock to answer any questions you may have about your policy or claims process. Additionally, customers have access to an online account portal where they can manage their policies and make payments with ease. If you’re seeking a bespoke approach to home insurance with excellent customer support and competitive pricing, then i4me limited might be the perfect fit for you.

2. Gateway Insurance Services Ltd

Gateway Insurance Services Ltd is one of the best home insurance companies in the UK. They provide a range of insurance policies to cater to different needs and budgets. One of the things that set Gateway Insurance apart from other companies is their commitment to providing personalized customer service. They value their clients’ satisfaction and work hard to ensure they receive prompt responses and resolutions for any issues that may arise. Another great thing about Gateway Insurance is the flexibility they offer with their policies. Customers can tailor their coverage options based on what suits them best, making it easier for them to get exactly what they need without paying extra for unnecessary services.

Gateway Insurance Services Ltd is one of the best home insurance companies in the UK. They provide a range of insurance policies to cater to different needs and budgets. One of the things that set Gateway Insurance apart from other companies is their commitment to providing personalized customer service. They value their clients’ satisfaction and work hard to ensure they receive prompt responses and resolutions for any issues that may arise. Another great thing about Gateway Insurance is the flexibility they offer with their policies. Customers can tailor their coverage options based on what suits them best, making it easier for them to get exactly what they need without paying extra for unnecessary services.

In addition, Gateway’s online platform makes it easy for customers to manage their policies and access important information at any time, from anywhere. The website also features informative resources such as articles on home security tips or frequently asked questions. If you’re looking for an affordable and reliable home insurance company with excellent customer service, then Gateway Insurance Services Ltd should definitely be on your list!

3. Premier Insurance

Premier Insurance is a UK-based company that offers home insurance policies to its customers. One of the unique features of Premier Insurance is their customized policy options, which allow customers to tailor their coverage according to their specific needs and preferences. When it comes to customer service, Premier Insurance has received positive reviews from its clients. They make sure that all customer queries are promptly answered and resolved in a professional manner. This level of service helps build trust with their clients and establishes a long-lasting relationship.

Premier Insurance is a UK-based company that offers home insurance policies to its customers. One of the unique features of Premier Insurance is their customized policy options, which allow customers to tailor their coverage according to their specific needs and preferences. When it comes to customer service, Premier Insurance has received positive reviews from its clients. They make sure that all customer queries are promptly answered and resolved in a professional manner. This level of service helps build trust with their clients and establishes a long-lasting relationship.

Premier Insurance also provides additional benefits such as accidental damage coverage, legal expenses cover, and no-claims discounts. These benefits add value to the overall package offered by the company. The claims process at Premier Insurance is straightforward and hassle-free. In case of an incident or accident, they guide you through each step until your claim is settled satisfactorily. Premier Insurance offers comprehensive home insurance policies with flexible options for customers looking for personalized solutions. Their excellent customer support ensures peace of mind knowing that they have got you covered in every possible way.

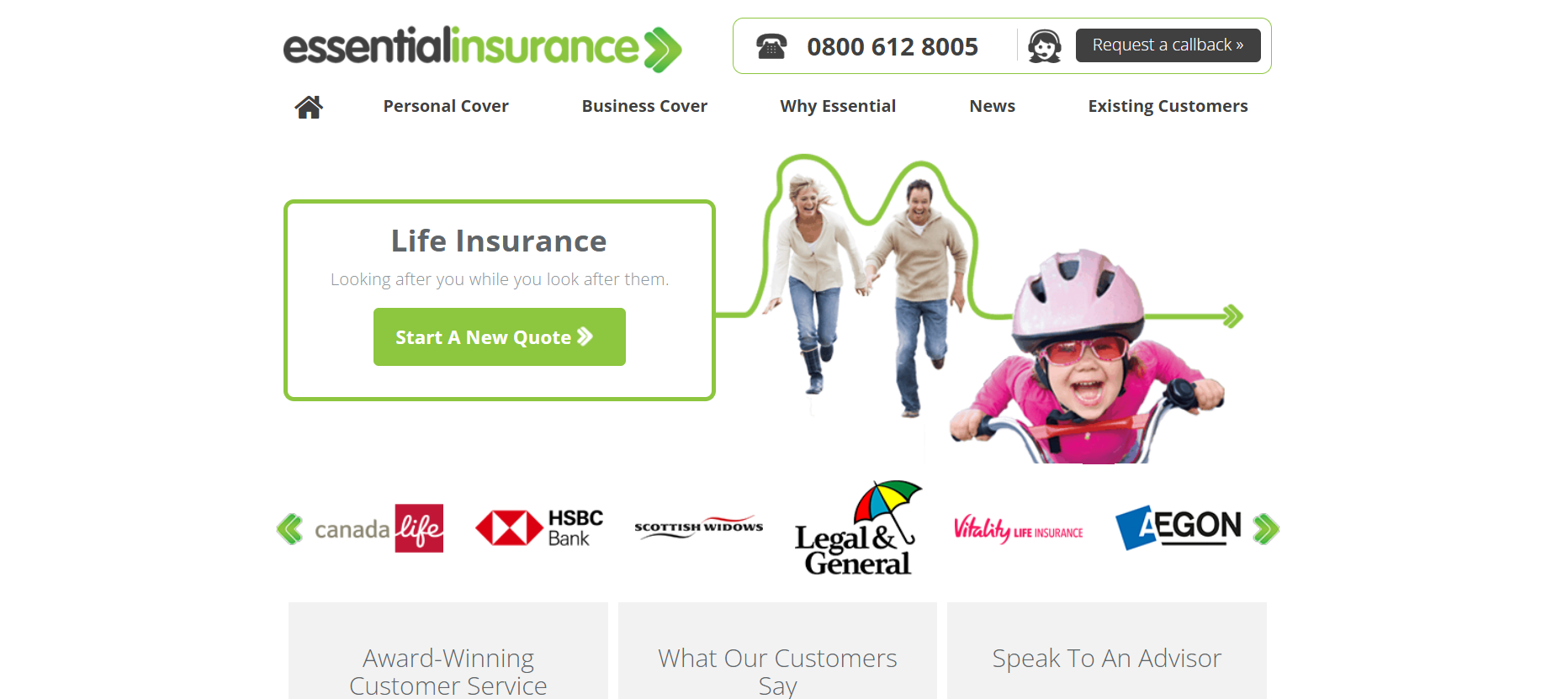

4. Essential Insurance

Essential Insurance is a UK-based insurance provider that offers a range of coverage options for homeowners. With over 30 years of experience in the industry, Essential Insurance understands the needs and requirements of their customers and provides tailored solutions to meet those needs. One of the standout features of Essential Insurance is their commitment to excellent customer service. They offer round-the-clock support through various channels, including phone, email, and online chat. This means that policyholders can get in touch with them at any time if they need assistance or have questions about their coverage.

Essential Insurance is a UK-based insurance provider that offers a range of coverage options for homeowners. With over 30 years of experience in the industry, Essential Insurance understands the needs and requirements of their customers and provides tailored solutions to meet those needs. One of the standout features of Essential Insurance is their commitment to excellent customer service. They offer round-the-clock support through various channels, including phone, email, and online chat. This means that policyholders can get in touch with them at any time if they need assistance or have questions about their coverage.

Essential Insurance also offers a wide range of add-on options to enhance your coverage. These include legal expenses cover, home emergency cover, and accidental damage cover. Policyholders can choose which add-ons they want based on their individual needs. Furthermore, Essential Insurance provides flexible payment options that make it easy for policyholders to manage their premiums. They offer monthly instalments as well as an annual payment option. Essential Insurance is a reliable choice for homeowners who value excellent customer service and flexible coverage options.

5. Townley Insurance Brokers

Townley Insurance Brokers is a UK-based insurance company that offers a wide range of home insurance policies to meet their clients’ needs. With over 40 years of experience in the industry, they have gained a reputation for providing excellent coverage and customer service. One thing that sets Townley Insurance Brokers apart from other companies is their personalized approach to each client. They take the time to understand your unique situation and tailor their policies accordingly. This means you get coverage that is specific to your needs and budget. Another great feature of Townley Insurance Brokers is their online quote system, which makes it easy for customers to get an idea of how much coverage will cost them without having to speak with an agent. However, if you prefer a more personal touch, they also offer phone consultations.

Townley Insurance Brokers is a UK-based insurance company that offers a wide range of home insurance policies to meet their clients’ needs. With over 40 years of experience in the industry, they have gained a reputation for providing excellent coverage and customer service. One thing that sets Townley Insurance Brokers apart from other companies is their personalized approach to each client. They take the time to understand your unique situation and tailor their policies accordingly. This means you get coverage that is specific to your needs and budget. Another great feature of Townley Insurance Brokers is their online quote system, which makes it easy for customers to get an idea of how much coverage will cost them without having to speak with an agent. However, if you prefer a more personal touch, they also offer phone consultations.

In addition to standard home insurance policies, Townley Insurance Brokers offers specialized coverages such as high-value homes and unoccupied property insurance. This makes them an ideal choice for those who need coverage beyond what traditional policies offer. If you’re looking for customized home insurance solutions backed by decades of experience in the industry, look no further than Townley Insurance Brokers.

6. UKinsuranceNET

UKinsuranceNET is a UK-based insurance provider that focuses on providing home insurance policies to homeowners. The company boasts of over 20 years of experience in the industry, making them one of the most reliable options for those looking for home insurance. One thing that sets UKinsuranceNET apart from other providers is their commitment to transparency and fairness. They offer a range of policy options at competitive prices, and they are always upfront about what is covered in each policy. This means that customers can make informed decisions when choosing which policy option best fits their needs.

UKinsuranceNET is a UK-based insurance provider that focuses on providing home insurance policies to homeowners. The company boasts of over 20 years of experience in the industry, making them one of the most reliable options for those looking for home insurance. One thing that sets UKinsuranceNET apart from other providers is their commitment to transparency and fairness. They offer a range of policy options at competitive prices, and they are always upfront about what is covered in each policy. This means that customers can make informed decisions when choosing which policy option best fits their needs.

In addition to offering traditional home insurance policies, UKinsuranceNET also provides specialist cover for unusual or non-standard properties such as listed buildings or homes with subsidence issues. This makes them an ideal choice for homeowners who may have struggled to find adequate coverage elsewhere. If you’re looking for a trustworthy and transparent insurer that offers both standard and unique policy options at competitive prices, then UKinsuranceNET might just be the perfect fit for your needs.

7. TopQuote

TopQuote is a UK-based insurance brokerage that specializes in providing home insurance policies to homeowners across the country. With over 30 years of experience in the industry, TopQuote has built a reputation for reliable and competitive coverage options. One of the standout features of TopQuote’s services is their commitment to personalized customer support. They offer dedicated account managers who can help guide customers through the process of selecting and purchasing a policy, as well as provide support throughout the duration of coverage.

TopQuote is a UK-based insurance brokerage that specializes in providing home insurance policies to homeowners across the country. With over 30 years of experience in the industry, TopQuote has built a reputation for reliable and competitive coverage options. One of the standout features of TopQuote’s services is their commitment to personalized customer support. They offer dedicated account managers who can help guide customers through the process of selecting and purchasing a policy, as well as provide support throughout the duration of coverage.

In addition to standard home insurance coverage options, TopQuote also offers specialized policies such as listed building insurance, high-value home insurance, and holiday home insurance. This ensures that they can cater to a wide range of homeowner needs and preferences. If you’re looking for an experienced provider with top-notch customer service and diverse policy offerings, TopQuote might be worth checking out when shopping around for your next home insurance policy.

8. A-Plan Insurance

A-Plan Insurance is an independent insurance broker that has been providing home insurance solutions for over 50 years. They have a wide range of policies available to suit different needs, from standard buildings and contents cover to specialist high-value homes. One of the things that sets A-Plan apart is their personalised service. Their team of experienced advisors will take the time to understand your specific requirements and tailor your policy accordingly. This means you can be confident you’re getting the right level of cover at a competitive price.

A-Plan Insurance is an independent insurance broker that has been providing home insurance solutions for over 50 years. They have a wide range of policies available to suit different needs, from standard buildings and contents cover to specialist high-value homes. One of the things that sets A-Plan apart is their personalised service. Their team of experienced advisors will take the time to understand your specific requirements and tailor your policy accordingly. This means you can be confident you’re getting the right level of cover at a competitive price.

A-Plan also offers a range of optional extras, such as legal expenses cover and accidental damage protection, so you can customise your policy even further. And in the event that you need to make a claim, their dedicated claims team will guide you through every step of the process. A-Plan Insurance is an excellent choice for anyone looking for comprehensive yet flexible home insurance coverage. With their focus on personal service and attention to detail, they are sure to provide peace of mind and security for homeowners across the UK.

9. Residentsline Flats Insurance

Residentsline Flats Insurance is a specialized provider of insurance policies for flats and apartments in the UK. They understand that owning a flat comes with unique risks, such as shared spaces, communal areas and multiple owners. As such, they offer comprehensive coverage designed to protect both property owners and tenants. One of the standout features of Residentsline’s policies is their flexibility. They provide tailored solutions based on individual needs, so you can select coverage options that suit your specific requirements. Whether you’re looking for building’s insurance or contents cover, they have got you covered.

Residentsline Flats Insurance is a specialized provider of insurance policies for flats and apartments in the UK. They understand that owning a flat comes with unique risks, such as shared spaces, communal areas and multiple owners. As such, they offer comprehensive coverage designed to protect both property owners and tenants. One of the standout features of Residentsline’s policies is their flexibility. They provide tailored solutions based on individual needs, so you can select coverage options that suit your specific requirements. Whether you’re looking for building’s insurance or contents cover, they have got you covered.

Another great aspect of Residentsline Flats Insurance is their commitment to customer service. Their team provides expert advice and guidance throughout the entire process – from selecting a policy to making a claim if necessary – ensuring customers feel fully supported at all times. Residentsline Flats Insurance offers peace of mind for anyone who owns or rents out a flat in the UK. With flexible policies and excellent customer service, it’s no wonder they are regarded as one of the best home insurance companies in the country by many homeowners and agents alike!

10. Safeguard UK Insurance

Safeguard UK Insurance is another reliable option for homeowners in the UK. Established in 1991, Safeguard has been providing quality home insurance policies to its customers for almost three decades. They offer various levels of cover and additional benefits that can be tailored to meet individual needs. One of Safeguard’s unique features is their “Home Emergency Cover” which provides immediate assistance in case of emergencies such as boiler breakdowns, plumbing issues or electrical faults. This feature not only gives peace of mind but also saves homeowners from unexpected costs.

Safeguard UK Insurance is another reliable option for homeowners in the UK. Established in 1991, Safeguard has been providing quality home insurance policies to its customers for almost three decades. They offer various levels of cover and additional benefits that can be tailored to meet individual needs. One of Safeguard’s unique features is their “Home Emergency Cover” which provides immediate assistance in case of emergencies such as boiler breakdowns, plumbing issues or electrical faults. This feature not only gives peace of mind but also saves homeowners from unexpected costs.

These top 10 home insurance companies provide comprehensive coverage at competitive rates with added features and benefits that make them stand out from the rest. It’s important to remember that every homeowner’s needs are different so it’s recommended to shop around and compare quotes before making a final decision on which company best suits your requirements.