Top 10 PayPal Alternatives in UK

Table of Contents

PayPal Alternatives in UK

Are you tired of relying on just one payment system for your business transactions? Do you want to explore other options beyond PayPal? Look no further! In this article, we have compiled a list of the top 10 PayPal alternatives in UK that you can use to diversify your payment options. From Wise and Google Pay to Stripe and Skrill, each alternative has its unique features that cater to different needs. So, let’s dive into the world of online payments and discover which alternative suits your business best!

1. Braintree

With its user-friendly interface and easy integration with other payment gateways, Braintree is a great PayPal alternative for businesses looking to expand their payment options in the UK. Owned by PayPal, it offers similar security features such as data encryption and fraud protection.

With its user-friendly interface and easy integration with other payment gateways, Braintree is a great PayPal alternative for businesses looking to expand their payment options in the UK. Owned by PayPal, it offers similar security features such as data encryption and fraud protection.

One of its most attractive features is that it supports over 130 currencies worldwide which makes it an ideal platform for international e-commerce businesses. It also provides recurring billing options which can be useful for subscription-based services.

In terms of pricing, Braintree charges a flat rate of 1.9% + £0.20 per transaction which is slightly lower than PayPal’s fees but still competitive within the industry.

Braintree offers a reliable payment gateway solution that is worth considering as a viable alternative to PayPal in the UK market. With its secure platform and flexible payment options, businesses can easily manage their transactions while providing customers with a seamless checkout experience.

2. Wise

Wise, formerly known as TransferWise, is a popular payment alternative in the UK that offers fast and affordable international money transfers. It’s an ideal option for small businesses or freelancers who frequently make cross-border transactions.

Wise, formerly known as TransferWise, is a popular payment alternative in the UK that offers fast and affordable international money transfers. It’s an ideal option for small businesses or freelancers who frequently make cross-border transactions.

One of the main advantages of using Wise is its low fees. Unlike PayPal, Wise doesn’t charge any hidden fees and provides you with real-time exchange rates to ensure transparency. Plus, it allows you to send or receive payments in multiple currencies without any additional charges.

Another benefit of Wise is its user-friendly interface. The platform is easy to navigate and offers a mobile app that lets you manage your account on-the-go.

Additionally, they offer 24/7 customer support through chat or email if you ever encounter issues while using their services. Wise is a reliable PayPal alternative for those seeking cost-effective international money transfers with excellent customer service and user experience.

3. Google Pay

Google Pay, formerly known as Google Wallet and Android Pay, is a popular digital wallet that enables users to make payments with their mobile devices. It allows you to add your debit or credit card details and use your phone to pay for goods and services in stores and online.

Google Pay, formerly known as Google Wallet and Android Pay, is a popular digital wallet that enables users to make payments with their mobile devices. It allows you to add your debit or credit card details and use your phone to pay for goods and services in stores and online.

One of the main advantages of using Google Pay is that it’s very easy to set up. All you need is a compatible smartphone and a payment method linked to your account. You can also use the app to send money instantly between friends or family members who have Google Pay accounts.

Another benefit of Google Pay is its security features. The app uses multiple layers of encryption to protect your financial information, so you can feel confident knowing that your data is safe from fraudsters.

If you’re looking for an easy-to-use digital wallet with robust security features, then Google Pay could be an excellent choice for you. It’s one among the top PayPal alternatives available in the UK market today!

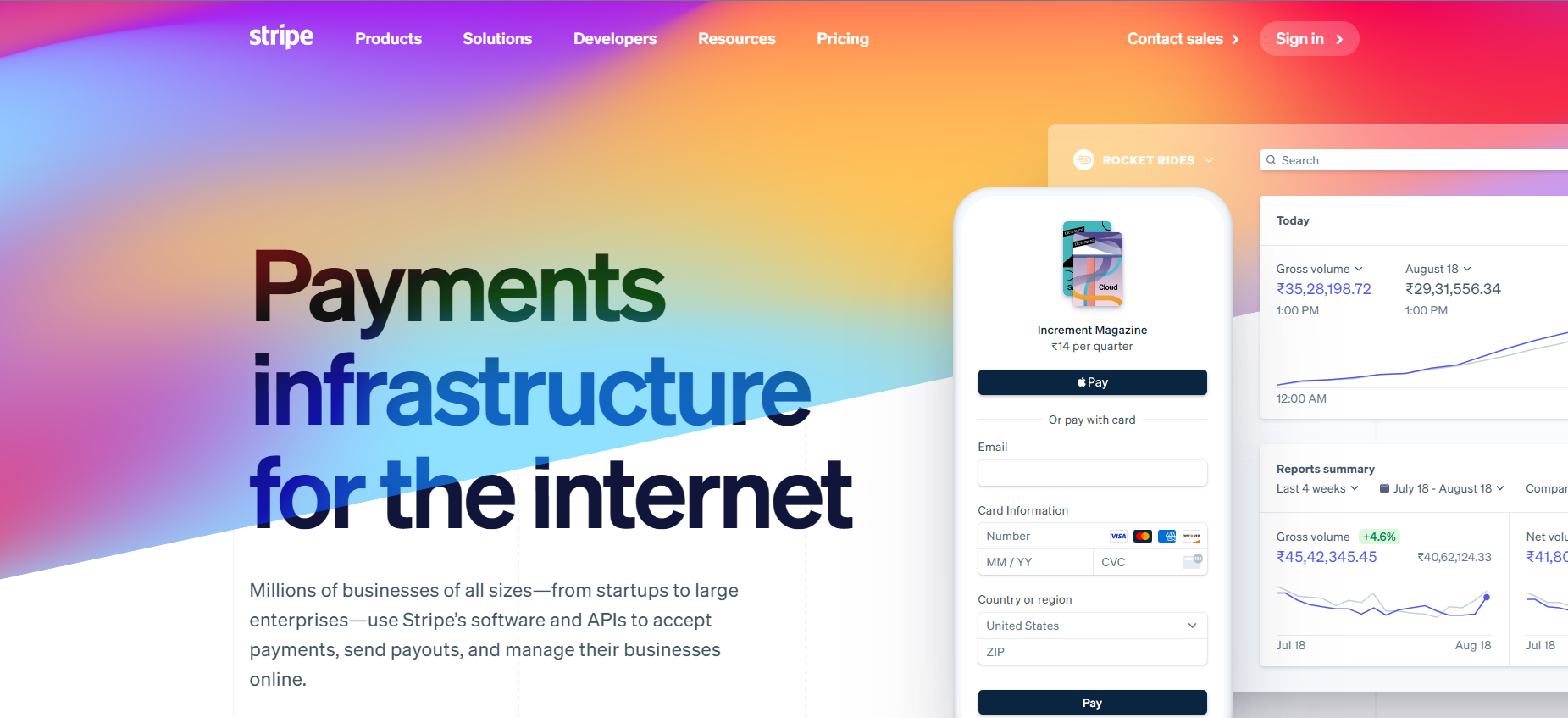

4. Stripe

Stripe is a popular payment gateway that offers businesses an easy and secure way to accept online payments. Founded in 2010, Stripe has quickly become one of the most widely used PayPal alternatives in UK due to its user-friendly interface and extensive features.

Stripe is a popular payment gateway that offers businesses an easy and secure way to accept online payments. Founded in 2010, Stripe has quickly become one of the most widely used PayPal alternatives in UK due to its user-friendly interface and extensive features.

One of the main advantages of Stripe is its ease of use. It allows merchants to integrate with their website effortlessly, regardless of whether they are using a pre-existing shopping cart or building their own custom solution. Additionally, with no setup fees or monthly charges, it’s also very cost-effective for small and medium-sized companies.

Stripe’s advanced fraud protection technology provides an extra layer of security by monitoring transactions for suspicious activity such as chargebacks and fraudulent purchases. This not only helps reduce risk but also ensures that customers’ personal information is kept safe.

Moreover, Stripe supports over 135 currencies worldwide which means it can be used by businesses operating globally, making it ideal for e-commerce websites selling products internationally.

5. Square

When it comes to choosing a PayPal alternative in the UK, Square is one of the top options available. This payment gateway solution allows businesses to accept credit and debit card payments online or in-person using their smartphone or tablet.

When it comes to choosing a PayPal alternative in the UK, Square is one of the top options available. This payment gateway solution allows businesses to accept credit and debit card payments online or in-person using their smartphone or tablet.

One of the key benefits of Square is its simplicity. It’s easy to set up an account and start accepting payments right away. Plus, there are no monthly fees or long-term contracts required, which can be appealing for small business owners on a budget.

Another advantage of Square is its versatility. Whether you’re running an online store, selling products at a physical location, or even providing services on-the-go, this platform can accommodate your needs with features like invoicing and recurring payments.

Square also offers fraud prevention tools and chargeback protection for added security when processing transactions. And if you ever need assistance with your account or have questions about using the platform, customer support is readily available via phone, email, or live chat.

Square is a reliable PayPal alternative that offers flexibility and ease-of-use for businesses looking to simplify their payment processing systems.

6. 2CheckOut

2CheckOut is an online payment processing platform that offers a range of features to help businesses manage their transactions effectively. With its user-friendly interface, 2CheckOut makes it easy for business owners to accept payments from customers across multiple channels.

2CheckOut is an online payment processing platform that offers a range of features to help businesses manage their transactions effectively. With its user-friendly interface, 2CheckOut makes it easy for business owners to accept payments from customers across multiple channels.

One of the key features of 2CheckOut is its ability to process payments in over 200 countries and territories worldwide. This means that businesses can expand their customer base beyond the UK without any limitations.

Another great feature of 2CheckOut is its fraud protection system, which includes advanced security measures such as two-factor authentication and real-time monitoring. This helps protect both the business owner and their customers from fraudulent activities.

Moreover, with its simple integration process, businesses can easily connect their website or app with 2Checkout’s API. The platform also supports multiple currencies so customers can pay in the currency they prefer.

In addition, merchants have access to detailed reporting tools which allow them to monitor sales performance and identify opportunities for growth. Plus, with customizable checkout pages, merchants can tailor the payment experience to match their brand’s look and feel.

If you’re looking for a reliable alternative to PayPal in the UK that provides excellent security measures and global reach capabilities – consider using 2CheckOut!

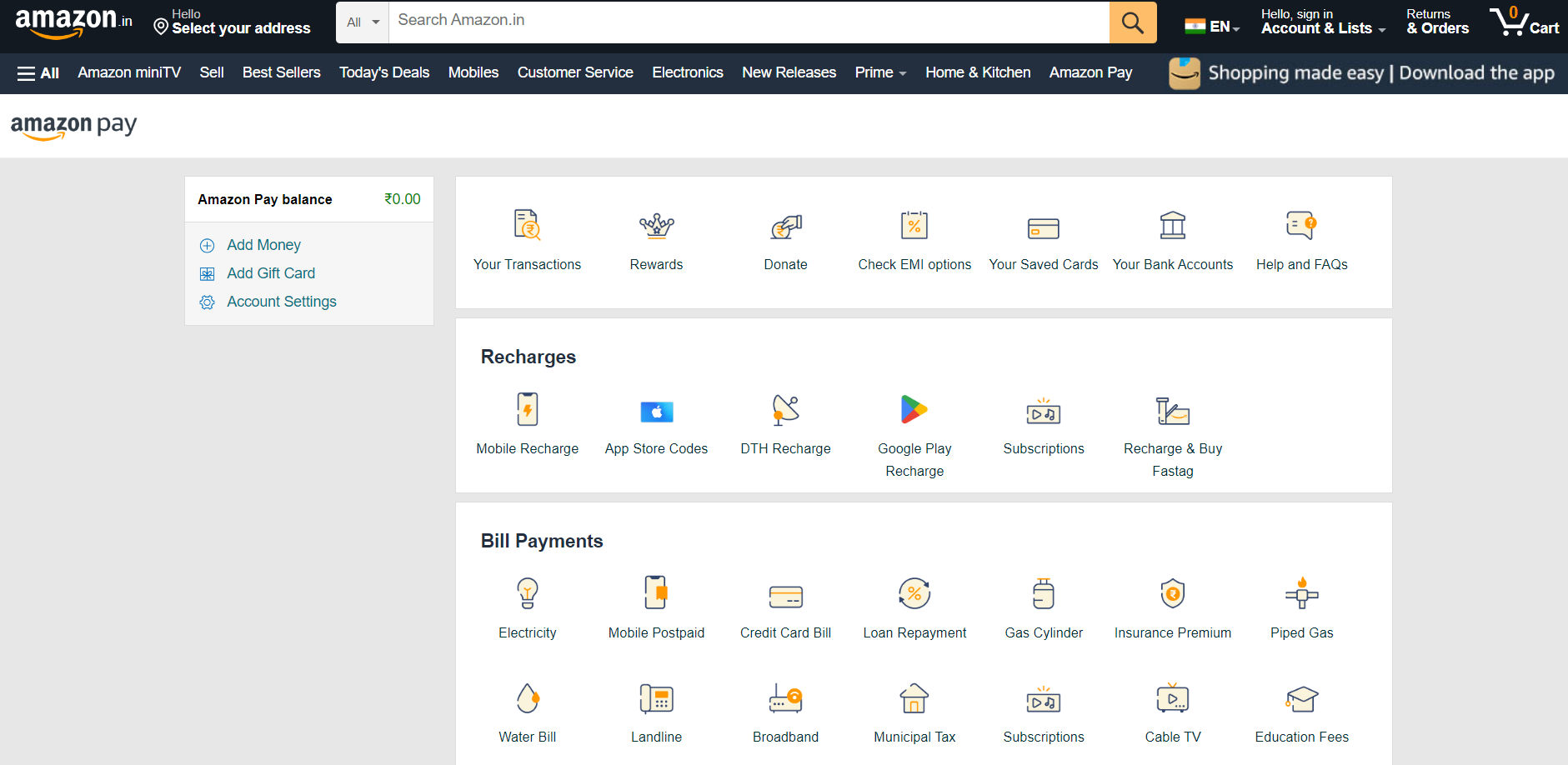

7. Amazon Pay

Amazon Pay is an online payment service that allows users to make purchases on external websites using their Amazon account. This means that users don’t need to enter their credit card information every time they make a purchase, as it is already saved in their Amazon account.

Amazon Pay is an online payment service that allows users to make purchases on external websites using their Amazon account. This means that users don’t need to enter their credit card information every time they make a purchase, as it is already saved in their Amazon account.

One of the benefits of using Amazon Pay is its security features. Since all payment information is stored in the user’s Amazon account, there’s no need to share financial details with third-party websites. All transactions are also protected by Amazon’s A-to-Z Guarantee, which covers eligible orders for up to $2,500.

Another advantage of using Amazon Pay is its convenience. Users can easily access and manage their payment methods through their Amazon account, making checkout faster and easier.

If you’re someone who frequently shops online and wants a secure and convenient way to pay for purchases without having to repeatedly enter your payment information, then consider giving Amazon Pay a try as one of your PayPal alternatives in UK.

8. Skrill

Skrill is an online payment solution that allows users to transfer funds between accounts and make payments. It was previously known as Moneybookers and has been around since 2001, making it one of the more established e-wallets available.

Skrill is an online payment solution that allows users to transfer funds between accounts and make payments. It was previously known as Moneybookers and has been around since 2001, making it one of the more established e-wallets available.

One of the main advantages of using Skrill is its wide availability – it’s accepted by many merchants worldwide. Additionally, Skrill offers a VIP program for high volume customers which can include lower fees and dedicated support.

Skrill also supports multiple currencies – over 40 in fact – so users can avoid conversion fees when making international transactions. Another standout feature of Skrill is its security measures, including two-factor authentication for account access.

However, some users have reported issues with frozen accounts or unexpected transaction fees. If you’re looking for a reliable PayPal alternative with global acceptance and strong security features, Skrill may be worth considering.

9. Apple Pay

Apple Pay is a digital wallet that allows users to make payments using their Apple devices such as iPhones, iPads, and even the Apple Watch. It was launched in 2014 and has since then gained popularity as a secure payment method.

Apple Pay is a digital wallet that allows users to make payments using their Apple devices such as iPhones, iPads, and even the Apple Watch. It was launched in 2014 and has since then gained popularity as a secure payment method.

To use Apple Pay, users simply need to add their credit or debit card details to their device’s Wallet app. Once set up, they can pay for goods and services by holding their device near an NFC-enabled terminal.

One of the major advantages of using Apple Pay is its security features. The service uses biometric authentication like Touch ID or Face ID which ensures that only the owner of the device has access to it. Additionally, when making a payment with Apple Pay, it generates a unique code for each transaction instead of sharing your actual card details with merchants.

Furthermore, many banks and retailers accept this form of payment which makes it very convenient for consumers who prefer contactless payments. However, some may argue that not all merchants support this payment method yet but this is changing rapidly across UK retailers.

If you’re someone who values convenience and security while making online transactions or shopping at physical stores then giving apple pay a try would be worth your time!

10. Verifone

Verifone is the tenth PayPal alternative on our list. It provides secure payment solutions to businesses of all sizes and types. Verifone’s Payment Gateway solution allows merchants to manage online transactions securely, efficiently, and with ease.

Verifone is the tenth PayPal alternative on our list. It provides secure payment solutions to businesses of all sizes and types. Verifone’s Payment Gateway solution allows merchants to manage online transactions securely, efficiently, and with ease.

With Verifone, you can accept payments from customers using various channels such as mobile, web-based portals or even through a point-of-sale device. This means that your business is not limited by geography or channel when accepting payments.

There are several alternatives to PayPal available in the UK market today. Each option comes with its unique features that cater to different needs based on the type of business one runs. From Wise for international transfers and Stripe’s customizable checkout process, to Square’s point-of-sale system and Skrill’s low transaction fees – there is something for every business owner looking for an alternative payment solution.

Whether you’re a small start-up or a large enterprise-level company operating globally – these ten PayPal alternatives provide reliable options that can help your business grow while providing convenience and security to both you and your customers during transactions online or offline.